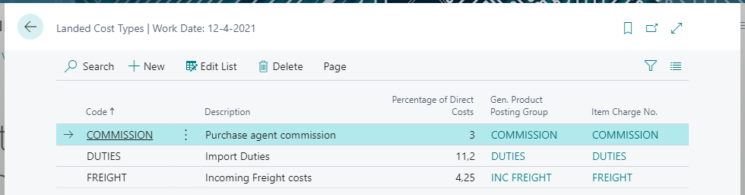

Identify the different cost types on the page Landed Cost Types:

The different columns or fields are explained below:

Code:

A general code that identifies a landed cost type. The code must be unique.

Description:

Description that explains the user what the code is used for.

Percentage of Direct Costs:

The default value of a percentage that is calculated over the direct unit cost (purchase price) for this cost type. This percentage can be modified per vendor and per item/vendor.

Gen. Product Posting Group:

Each landed cost type must refer to a General Product Posting Group, to identify the General Ledger Account for posting indirect costs (accrual and actual) per type.

Item Charge No.:

If you add the actual costs of the different cost types to item ledger entries, the Item Charge No. needs to be identified. By using the mentioned Item Charge No. the corresponding accrual value entries will be reversed on posting the purchase invoice with item charges.

Central Solutions

Strijdakker 17 | 5673 TN | Nuenen

Chamber of Commerce 75296497

BTW ID NL860227790B01

All rights reserved - Central Solutions 2021