Landed costs will be credited on the general ledger account when you post a purchase invoice with items. These amounts are meant to cover purchase costs and will be part of the cost price of items.

The value is debited on the Inventory Account no.

By posting purchase invoices for the actual costs on the same general ledger account as the landed cost, the total balance of this account will be the general purchase result for that landed cost type. But if you use 2 different account nos. for the landed cost and the actual cost, the balance between these 2 accounts will give the same result.

! In this case, actual costs will not be calculated in the cost price of an Item Ledger Entry.

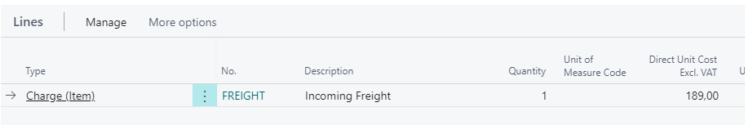

If you need to recalculate the cost price of individual Item Ledger Entries, you may post purchase invoices with Item Charges for the actual landed costs (Freight, Duties, Commission, etc.). The amounts of these invoice lines can be divided over different purchase receipt lines.

Remark: Posting Item Charges is a standard Microsoft Dynamics 365 Business Central function. Assigning item charges to purchase receipt lines is explained in the standard documentation.

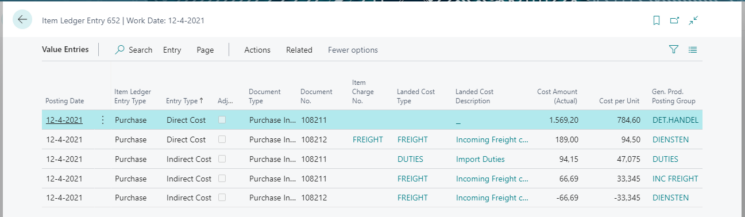

The individual actual costs of the purchase invoice with item charges will be added as extra value entries to an item ledger entry.

An Item Charge value entry is added for the actual costs with entry type Direct Cost. The original indirect cost entry for the landed cost type will be reversed by adding an indirect cost value entry for this landed cost type.

This results in a new cost price for each item ledger entry. Depending on the settings in the Inventory Setup, the cost price will be copied to the sales shipment to recalculate the sales order statistics.

Remark: The example above is an item with a FIFO cost method. In case the cost method is STANDARD (or FIXED), additional value entries are created with postings for the variance account of the item charge no. for the mentioned General Product Posting Group. This will not affect the cost price, because it is fixed. But the variance account for the cost type will show the general purchase results for this cost type.

Central Solutions

Strijdakker 17 | 5673 TN | Nuenen

Chamber of Commerce 75296497

BTW ID NL860227790B01

All rights reserved - Central Solutions 2021