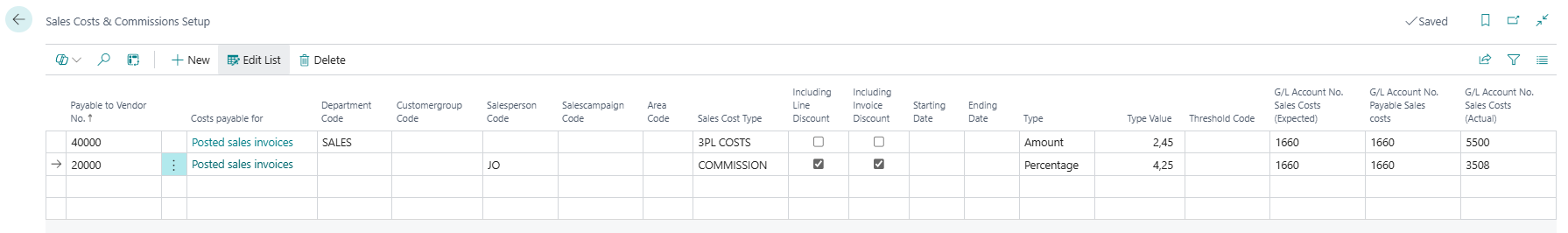

On the Sales Costs & Commissions Setup page, the different levies, commissions and other costs to be paid off are identified.

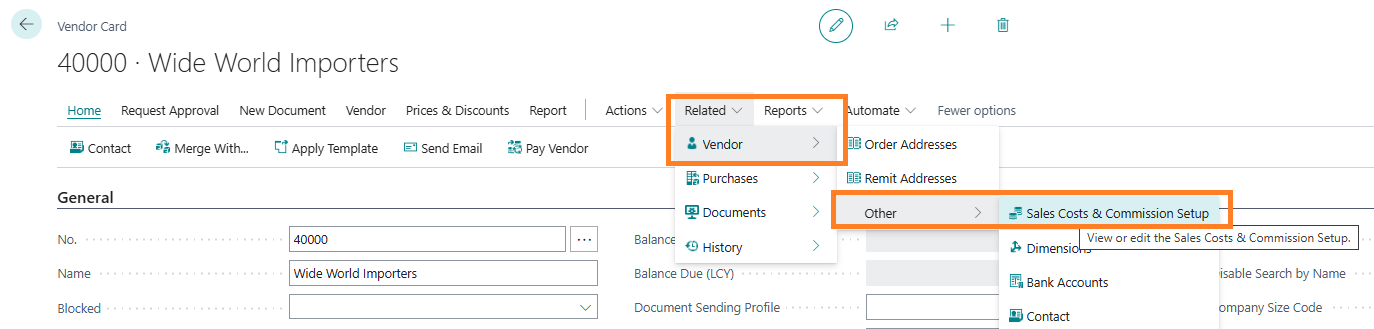

This page is also accessible from the vendor card page:

The different columns or fields are explained below:

Payable to Vendor No.:

This is the number of the vendor that needs to be paid off.

Costs payable for:

Displays the setting on the vendor card page when costs are applied, either on posted sales invoices or on paid (settled) sales invoices.

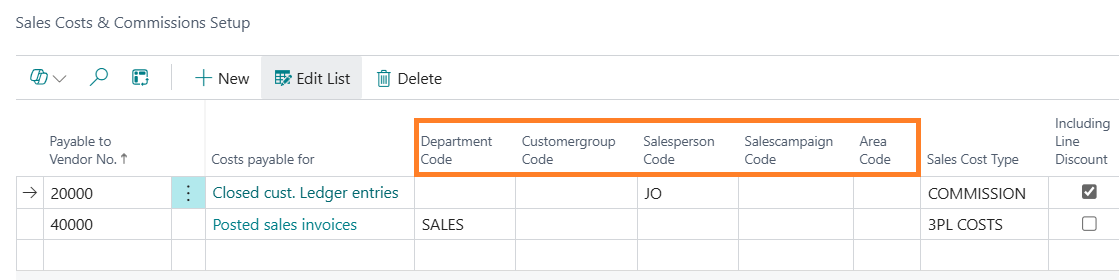

The following columns are displayed based on the shortcut dimensions as set in the General Ledger Setup. These columns are used as filters for the same columns in the sales lines.

Sales Cost type:

Shows the cost type that is used on purchase invoice for this vendor and in sales cost entries.

Including Line discount:

Marks if the sales costs are calculated for a base amount including line discount.

Remark:

This is only applicable for percentages of the base amount that needs to be paid.

Including Invoice discount:

Marks if the sales costs are calculated for a base amount including invoice discount.

Remark:

This is only applicable for percentages of the base amount that needs to be paid.

Starting date:

The first date that the setting of this line is valid.

Ending date:

The last date that the setting of this line is valid.

Type:

Indicates whether a percentage of the base amount or a fixed amount needs to be paid.

Type value:

Displays the amount or the percentage of the base amount, based on the Type column.

Threshold code:

Threshold codes can be assigned to determine different sales costs or commissions if larger discounts are granted by the salesperson to the customer. In that case, the sales costs will be different from the standard setting in the Type Value column.

The Threshold settings will be explained in the next chapter.

G/L Account No. Sales Costs (Expected):

Identifies the G/L Account no. where the expected costs are posted. These costs are posted upon posting a sales order or a sales invoice. This should usually be a balance account.

G/L Account No. Payable Sales Costs:

Identifies the G/L Account no. where the payable costs are posted. These costs are posted when a sales invoice is posted or completely settled (based on the setting Costs payable for). This should usually be a balance account.

G/L Account No. Sales Costs (Expected):

Identifies the G/L Account no. where the actual costs are posted. These costs are posted upon posting a purchase invoice for the sales costs to be paid. This should usually be an income statement account.

Central Solutions

Strijdakker 17 | 5673 TN | Nuenen (NL)

Chamber of Commerce 75296497

VAT ID NL860227790B01

support@central-solutions.nl

+31 85 401 73 40