Landed costs will be credited on the General Ledger Account No. specified as Overhead Applied Account in the General Posting Setup when you post a purchase invoice with items. These amounts are meant to cover purchase costs and will be part of the cost price of items. The value is debited on the Inventory Account no.

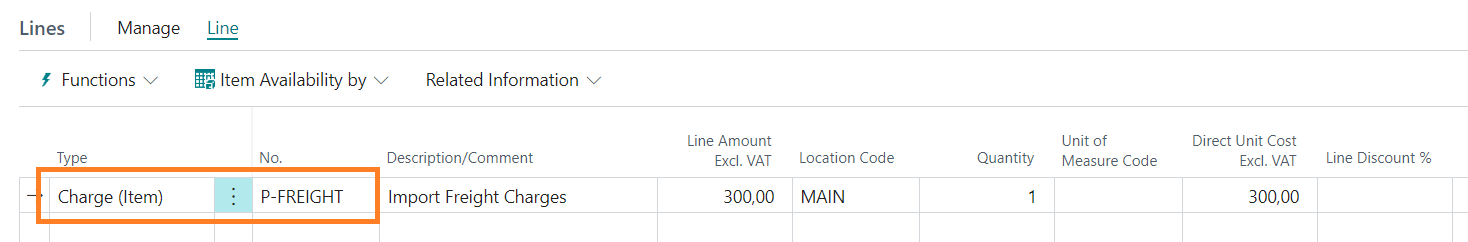

If you need to recalculate the cost price of individual Item Ledger Entries, you may post purchase invoices with Item Charges for the actual landed costs (Freight, Duties, Commission, etc.). The amounts of these invoice lines can be divided over different purchase receipt lines.

Note:

Posting Item Charges is a standard Microsoft Dynamics 365 Business Central function. Assigning item charges to purchase receipt lines is explained in the online Microsoft 365 Business Central

documentation.

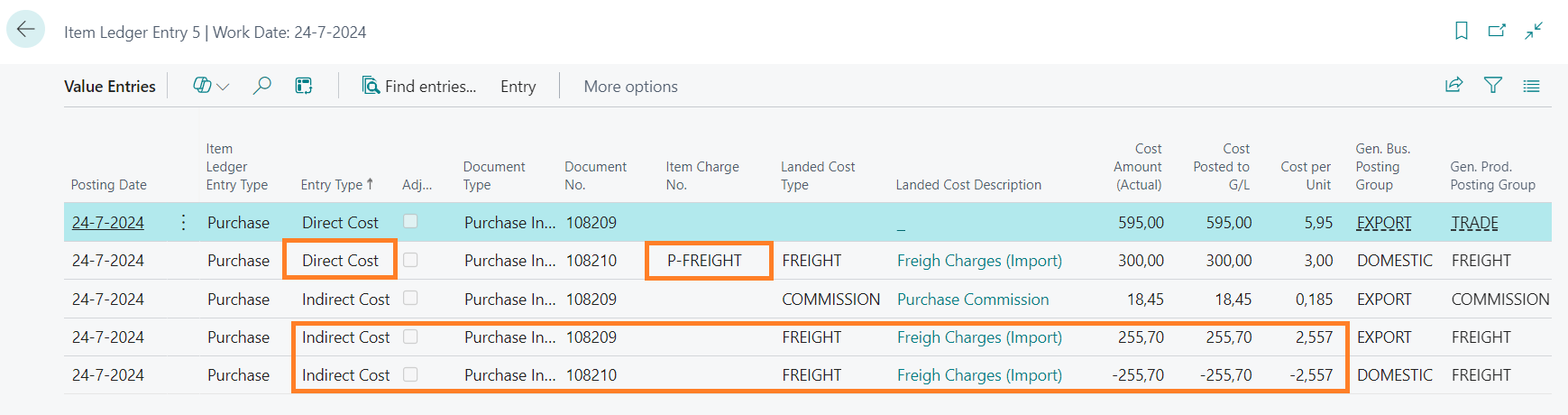

The individual actual costs of the purchase invoice with item charges will be added as extra value entries to an item ledger entry.

An Item Charge value entry is added for the actual costs with entry type Direct Cost. The original indirect cost entry for the landed cost type will be reversed by adding an indirect cost value entry for this landed cost type.

This results in a new cost price for each item ledger entry.

Note:

The example above is an item with a FIFO costing method. In case the costing method is STANDARD (or FIXED), additional value entries are created with postings for the variance account of the item charge no. for the mentioned General Product Posting Group.

This will not affect the cost price, because it is fixed. But the variance account for the cost type will show the general purchase results for this cost type.

Central Solutions

Strijdakker 17 | 5673 TN | Nuenen (NL)

Chamber of Commerce 75296497

VAT ID NL860227790B01

support@central-solutions.nl

+31 85 401 73 40